At our foundation, its Sidra System is an example of a public digital network that has been developed aiming to facilitate monetary transactions aligned with strict conformity with Islamic law. Instead of conventional digital ledgers that just enable direct transactions, the Sidra Solution is distinctively designed averting practices which clash Islamic principles. With integrating these particular ethical criteria into this blockchain design, its Sidra Chain not only ensures transactions but also verifies that all financial process aligns with its moral and legal standards of religious finance.

Novel Features of this Sidra Platform

The Sidra Network emerges apart beside traditional transactional systems using its set of cutting-edge features tailored specifically for Shariah-compliant financial activities. A primary characteristic is its provision for specialized mechanisms such as ethical bonds and sale-based financing. ethical bonds allow shareholders to jointly own an equity share of physical assets rather than merely lending money accruing interest. That Murabaha involves a pre-agreed profit financing model where the profit margin is fixed in prior, thereby eliminating the inconsistencies associated with riba payments.In addition to these investment products, this Sidra Solution leverages automated contract technology to execute and safeguard the performance of economic agreements. The aforementioned smart contracts ensure that all stipulations agreed upon by the concerned parties are executed automatically, consequently reducing the reliance upon intermediaries and minimizing the possibility of problems or fraud. Moreover, the platform’s mining process is engineered to be user-friendly, allowing participants to process transactions and collect rewards without the necessity for expensive technology. This accessibility empowers the processing process and complies with the platform’s overall objective of fostering inclusiveness.

Another key characteristic of Sidra Platform is its proprietary digital coin – the Sidra Coin. This asset is employed for conducting transactions, covering services within the solution, and recognizing ecosystem participants for their involvement in preserving the blockchain platform.

Contribution on Moral Finance and Further

The arrival of our Sidra System represents a notable turning moment for Shariah finance. Traditional financial institutions have typically been challenged to harmonize modern banking technology with rigorous requirements of Islamic law. Its Sidra System bridges this void by introducing a network that is both digitally advanced and strictly sound. Its audit-friendly and decentralized structure provides that all exchanges are executed in a manner that is auditable to inspection, which is a critical requirement of moral finance. This auditability not only generates trust among clients but also boosts the overall credibility of transactional operations.Moreover, its Sidra Network’s capacity to simplify global payments with minimal fees and minimal processing delays could revolutionize transnational trade and financial flows, particularly for segments that conform to faith-based principles. In locales where standard banking frameworks have proved insufficient to provide inclusive financial offerings, its Sidra Platform presents a feasible alternative Sidra chain login that is both inclusive and compliant with faith-based guidelines. With a bridge between the chasm between advanced digital finance and conventional ethical banking, the network is positioned to promote equitable financial services on a international scale.

Barriers and Future Possibilities

Notwithstanding its numerous merits, the Sidra Solution faces a number of challenges as it develops and broadens. Administrative hurdles remain a major concern, as the merger of state-of-the-art blockchain technology and traditional Islamic finance is yet relatively nascent and vulnerable to shifting legal understandings. Sustaining consistent Shariah compliance across various jurisdictions requires ongoing collaboration with faith-based scholars and investment experts. Additionally, as with most blockchain solution, issues related to capacity, information security, and infrastructure stability require to be resolved to ensure long-term viability.Looking ahead, the direction for the Sidra Network seem promising. With heightening global focus in Shariah-compliant finance and copyright assets, the platform is primed to win over a expanding market segment that values visibility and alignment. Sustained technological advancements and critical partnerships are poised to boost its capabilities and diversify its client base. As the platform evolves, it may well become the paradigm for Islamic financial services, setting a benchmark for the industry to imitate.

Mr. T Then & Now!

Mr. T Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Jane Carrey Then & Now!

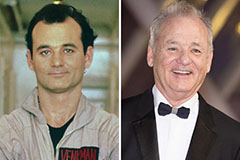

Jane Carrey Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!